There’s nothing more frustrating for a customer than patiently waiting for their product to arrive only to pop open the package to find it has been damaged in transit.

It’s one of the major risks of buying online, and a good reason why offering postal insurance to your customers makes sense.

With postage insurance in place, your customer can be assured of a timely replacement, and as the seller, you’d don’t have to reach into your pocket to pay for it.

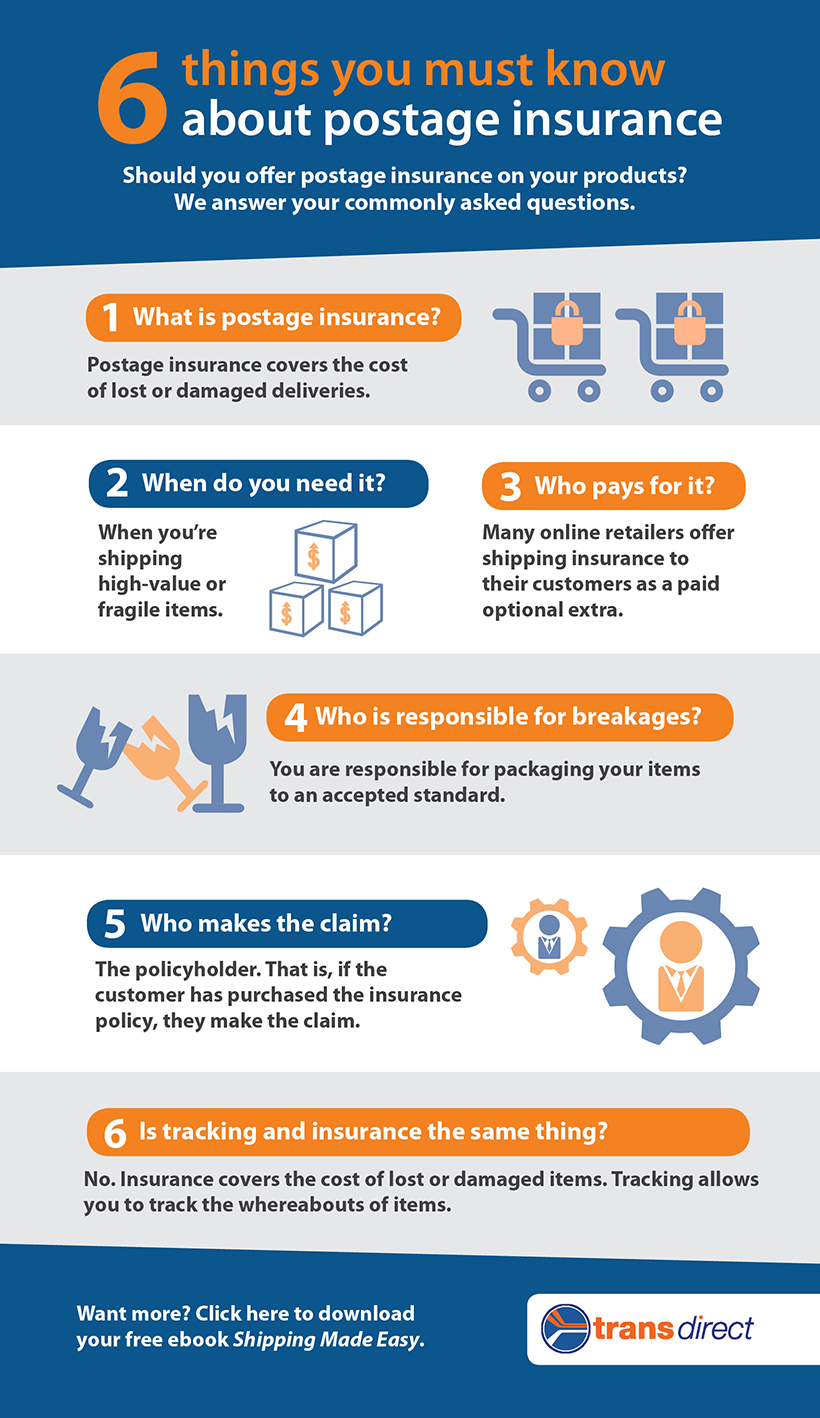

But is postage insurance really worth it? And who pays for it? Here we answer six commonly asked questions about postage insurance…

1. What is postage / shipping insurance?

Postage or shipping insurance covers the cost of lost or damaged deliveries. It is broadly divided into three categories:

1. Carrier insurance: This is insurance provided by your shipping company. It may be included as part of their delivery quote or paid for as an optional extra.

2. Third party insurance: This is shipping insurance that’s provided by an external insurance company. It tends to be used for international shipping or for delivering high-value goods.

3. Self insurance: This is when the seller assumes responsibility for lost or damaged goods and will cover replacement costs for the buyer.

2. When do you need it?

It’s a good idea to offer postage insurance when you’re shipping high-value or fragile items.

Most courier companies offer relatively inexpensive shipping insurance, which may be passed onto your customers as part of the delivery quote, or selected as an optional extra.

It really comes down to a cost vs risk analysis. That is, is the value of your product high enough and the risk of damage likely enough to justify the cost of insurance?

For example, Transdirect offers shipping insurance for $6.36 for items with a declared value of $0 – $1,500 and $11.50 for items valued between $1,501 and $4,500. So if you’re shipping a product worth $500, insurance will cost you just over 1 per cent of the overall price.

3. Who pays for it?

Many online retailers offer shipping insurance to their customers as a paid optional extra they can select during the checkout process.

If you offer all-inclusive free delivery, insurance can be included in the delivery quote that’s either covered by your profit margin, or built into the overall price of the product.

If you ship low-value, hardy items, you may choose to offer self insurance and cover any replacement costs yourself as an added incentive for your customers.

4. Ensuring your shipment is covered

As the seller, you are responsible for packaging your items to an accepted standard to prevent damage under most shipping insurance policies.

Some carriers may not offer insurance for certain types of items, e.g. china, alcohol, commercial bulk hazardous goods so it is wise to check the conditions before signing up.

5. Who makes the claim?

The policyholder makes the claim.

If your customer has purchased optional insurance through the shipping company or a third party supplier, it will generally be up to them to make a claim on any damaged or lost goods.

On the other hand, if you provide insurance on all your products through a third party insurer, then it’s likely that you are the policyholder and will be responsible for making the insurance claim.

6. Is tracking and insurance the same thing?

No. Shipping insurance covers the cost of lost or damaged items. Tracking allows you and your customer to track the whereabouts of items throughout the delivery timeline – it doesn’t pay for lost or broken items.

Ready to start shipping? New customers get a quote, or existing members please sign in.

Want more? Then why not download the entire guide: