Choosing an ecommerce payment gateway is one of the most important decisions you can make for your online store operations.

The cheapest option is not always the best.

You have a complex decision ahead of you.

There’s a bunch of factors you need to consider.

And the stakes are high enough to warrant some detailed analysis and intensive research. The security implications of managing customer payments are significant.

You have a serious task on your hands.

You need to get this decision right, or you risk making a very expensive and time-consuming mistake.

To get your research started, we’ve rounded up the best payment gateway comparison guides and resources to help you understand the main pros and cons separating each option.

Each alternative has slightly different advantages – it’s your job to assess the features and benefits your business needs the most. These resources are from some of the ecommerce industry’s most helpful publications and experienced expert contributors, so you can be sure the information provided is trustworthy and current.

But before you go ahead and start comparing options – you need to understand how to separate the good from the bad and the right from the not-so-right.

The first few resources in our roundup will help you understand the criteria you need to use to make an informed, strategic decision to suit your brand’s specific needs.

How to narrow down your payment gateway options

WooCommerce has one of the most helpful dedicated ecommerce blogs in the business, and their Content Manager, Nicole Kohler has published an informative article outlining how payment gateways work, and what criteria you should use to decide on the best option for your store.

This two-minute video gives you a good primer on the critical factors differentiating each of the major ecommerce payment gateway platforms.

Have a quick watch so you understand what you need to consider before we share a number of payment gateway comparison guides with you.

The ecommerce payment gateway red flags you need to avoid

It’s just as important for you to look for the deal-breakers when selecting an ecommerce payment gateway for your brand.

Many ecommerce retailers view payment gateways as a necessary evil, and without quality customer service and exemplary security – the wrong operator could bring your operations significant problems.

Paul Paradis is the Chief Business Development Officer at Sezzle, a ‘digital debit’ platform that allows merchants to reduce processing costs and enables their customers to pay directly from a bank account. Paul shared a nice rundown of the five biggest payment gateway problems you need to avoid with the digital marketing publication Smart Insights.

It’s worth noting Paul’s software at Sezzle is an alternative to the mainstream payment gateways, so the article does have a slant. However, the information provided is still super helpful when considering your choice.

10 Tips to help you choose the right payment gateway option

Lucas Jankowiak, writing for the blog of marketing software provider, Get Response uses the perfect analogy to explain the payment gateway purchase decision process.

If you have just five options to choose from on your supermarket shelf – the decision you make is relatively straightforward.

When you have three shelves filled with near hundreds of different brands and variations, you enter a state of confused paralysis. The decision becomes overwhelming and intimidating.

Lucas wants to give you a checklist to help you turn that confusion into practical action, by giving you 10 considerations to focus on when making your final decision.

Things like location, customer support, ease of integration, fees, design ramifications, reach and security should be at the forefront of your decision-making.

Don’t just settle for the cheapest or most popular solution. There could be a better option out there to suit your store’s specific needs.

A comparison of payment gateway providers in Australia

Jason Andrew, Founder of online bookkeeping service SmartBooks Online, penned a LinkedIn article with a concise and wisdom-filled summary of the reasons for choosing to incorporate a payment gateway into your online store operations. It’s important to consider the financial ramifications of your decision, and Jason provides a clear and succinct costs-benefits framework for you to use.

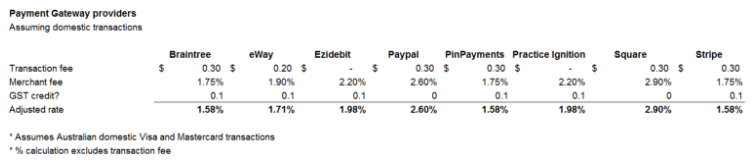

Jason’s article includes a handy comparison table reviewing the most common (and a few less common) payment gateway providers, ranked by price-per-transaction (factoring the GST input credit available to be claimed by Australian businesses).

Jason’s conclusion favours three payment gateways over the trailing four competitors.

“Factoring the eligibility to claim GST credits on the transaction, Braintree, Stripe and PinPayments are the providers which provide the most ‘bang for buck”.

Stripe VS eWay comparison

eWay is the Australian gateway powering payments for the majority of the online stores Down Under. According to figures reported by Power Retail, eWay processed around one-quarter of all Australian online transactions in 2015.

Matt Bullock founded eWay in Canberra in 1998, and since then the business has flourished alongside consistent growth in Australian ecommerce sales – as evidenced by the US $50 million price tag Global Payments shelled out to acquire the eWay in 2016.

Global Payments CEO, Jeffrey Sloane clearly has big plans for the Asia Pacific payment gateway market, so you can rest assure eWay will be one of the major players for many years to come:

“The combination of eWay’s cutting edge products with Ezidebit complements our global omnichannel solution strategy and will create the leading payment technology company in Asia-Pacific with nearly 40,000 merchant customers in Australia and New Zealand.”

In contrast, Stripe is the new punk on the block with global aspirations and some serious support from a huge tribe of industry customers and advocates. Australian retail consultant, James Hammon explains why Stripe’s Australian launch in 2014 changed the payments game:

“The chief advantage of Stripe and it’s Australian early-mover competitor, Pin Payments – was the reduction in red tape required to process credit cards. Surprisingly, this doesn’t come at the expense of security.”

Some experts will argue that one of eWay’s primary advantages is in fraud protection, whereas Stripe’s friendliness to development allows retailers to easily customise their checkout experiences (rather than having to rely on generic out-of-the-box solutions).

WooCommerce’s Nicole Kohler provides an excellent explanation of the importance of eveloping a checkout process to maximise your customer experience.

Nicole demonstrates why the right payment gateway can give your online store a genuine advantage in conversion rate optimisation, and why the wrong choice can have a direct impact on your cart abandonment (and even lifetime customer value) rates.

Stripe and eWay are often the two alternatives Australian ecommerce brands consider. Digital strategy agency, The Hope Factory have put together an invaluable, helpful and thorough comparison of the two platforms. If you’re tossing up between these two options, look no further than this guide.

PayPal VS Stripe comparison

If you’re interested in some case studies and stories from real, objective ecommerce entrepreneurs – this Shopify University forum thread has some valuable information from business owners with first-hand experiences.

Christopher Odell, Founder of Datsusara Hemp Gear, shares his A/B testing results between Stripe and PayPal – two of the industry’s most prominent solution providers. The info gives you a useful insight into the pros and cons of PayPal and Stripe.

Worldpay vs Authorize.net vs Adyen vs Stripe vs PayPal comparison

Catalin Zorzini is the Founder of Ecommerce Platforms – an online publication specialising in online retail technology. These guys know ecommerce software better than you know your Uncle.

You can be sure this comparison guide on five of the world’s most popular ecommerce payment gateways is rigorously researched, expertly analysed and fairly judged.

This guide has been contributed by Matt Collins, an ecommerce tech expert who runs PaymentBrain – a website dedicated to payment processing education.

As well as comparing the pros and cons of each of these five platforms, Matt also outlines ten critical factors you need to consider when make your own choice on the best solution to fit your business needs.

Stripe vs PayPal vs Amazon vs Authorize.net vs Braintree vs Worldpay vs Orbital Chase comparison

Jenna Compton is the Director of Marketing at Blue Stout – an ecommerce design and development agency that runs one of the industry’s most informative marketing blogs.

Jenna has put together a comparison guide detailing seven of the most widely-used payment gateways in the industry.

The article gives you a brief overview of each alternative, an idea of pricing and contract length, and a rough outline of the advantages and disadvantages.

The best part of Jenna’s article is the addition of examples ecommerce brands who are using each payment gateway featured. This will allow you to take a look at the front end of these sites and how the payment gateway integrates with the rest of each brand’s customer experience.

Some platforms are more customisable than others – and if aesthetics and design are important to your brand, this could be a differentiating factor.

The every-payment-gateway-you-could-dream-of comparison

Anyone considering a new payment gateway should be so grateful that the Gateway Index exists. Direct your thanks towards Spreedly, a software application specifically for managing payments that allows you to manage compliance requirements, securely vault customer data and setup a backup in the case of payment gateway downtime.

Spreedly integrates with hundreds of payment gateways and they understand the importance their customers place on selecting the right option. In collaboration with Shopify (one of the ecommerce world’s most popular online store platforms), Spreedly developed the Gateway index by compiling the rich and plentiful data available to both companies.

The result is an interactive chart, complete with an exhaustive comparison table ranking 55 different payment gateways based on five important criteria:

- Success rate

- Processing speed

- Tracked volume

- Countries supported

- Average ticket size

Unfortunately, the index has not been updated since May 2015. However, the analysis of each platform is extensively detailed, and mostly still relevant.

Before you make a final decision on your payment gateway, be sure to check out the Gateway index.

A visual checklist to help you choose the right payment gateway for your store

To finish off our roundup of the most trustworthy and helpful resources you need to research your ecommerce payment gateway solution – we wanted to share this checklist-style infographic developed by enterprise solutions provider, Kays Harbour Technologies.

This visual guide gives you an ideal overview of the detail offered by the guides we have featured in this article.

Kays managed to squeeze a whole bunch of useful info into one easy-to-digest infographic, including:

The common types of payment gateways

The benefits and challenges you must consider

Six questions you need to ask yourself before making a choice

A list of the 10 most popular platforms in the US

And a comparison table of the top 5 options in the US market

If there are any questions at all you have regarding ecommerce payment gateways, be sure to contact the Transdirect team directly. Whilst we aren’t experts on the topic, we are well-informed, and we can offer an unbiased, objective perspective on your specific situation and decision.

We might even be able to put you in touch with other online retailers who are working a payment gateway you are considering so you can get a firsthand account of the product in action.

Good luck and happy reading!